|

|

Role of markets in the environmentAustralia’s market economy is based on voluntary trading of goods and services, in which individuals and businesses determine the quantity and prices of these goods and services[6]. These “free markets” are usually good at coordinating the delivery of a wide range of goods and services. However, when it comes to the environment, and valuation of ecosystem services, it is widely accepted that there are limits to how the market functions. Quick facts

Market failure is a economic term that refers to a situation where a market does not allocate resources efficiently, which means that the overall welfare of society is lower than it could have been[6]. There are various reasons for market failure and for environmental issues these primarily relate to the characteristics of some goods and services, and the availability of information. Some goods and services have certain characteristics that mean that they are provided at a higher or lower level compared to what would be an optimal amount from a societal perspective. The existence of (a) public goods, (b) common property resources and (c) externalities can explain why the environment is not adequately considered in the market in Australia and elsewhere. (a) Pure public goods are defined as having both of the following characteristics[6]:

The reason public goods are often not provided at a socially desirable level, or even at all, is that the characteristics above make it difficult to charge for their provision – it is not easy to charge people for a good or service if it is unclear whether they have used it or not, or if there is no way to stop them using it even if they do not pay[6]. It can also be difficult to know what price to charge. (b) There are also times that goods or services that have just one of the characteristics above, or only possess them to a certain scale or degree, making them “impure” public goods. Common property resources, for example, are defined as being non-excludable but rivalrous[2]. This means that anyone can use a common property, but one person’s use may diminish the availability of the resource for another person’s use. Because of these characteristics, common property resources are vulnerable to over-use. A common property resource which has been often been overexploited is ocean fisheries, where overfishing may diminish the fishing population and in extreme situations can cause the fish population to disappear or become economically extinct, such as happened with the Atlantic cod fishery[5]. This phenomenon of individuals focusing on their own use and damaging the resource for everyone, including themselves, is known as the tragedy of the commons. (c) Externalities occur when there is a spillover of costs or benefits from an action that are external to the person taking the action[6]. These externalities can be negative or positive. For example, a factory may cover the costs of producing their saleable product, but may not always bear the cost of associated pollution – the community bears the cost, which makes this a negative externality. Similarly, a person who chooses to drive their car takes into account some of the private costs, such as the cost of fuel, but might not pay for the costs of the associated greenhouse gas emissions. A person who creates a treed garden in their house derives benefit from it, but they can also generate community benefits such as urban cooling, local biodiversity and aesthetic pleasure, which are positive externalities to their community. Negative externalities tend to be over-produced because the full costs are not fully considered in the economic system. Positive externalities tend to be under-produced because people are not fully rewarded for their provision[6]. The other market failure particularly relevant to the environment is information failure. This is when parties involved in a transaction do not hold all the information they need to make a good decision when buying or selling a good or service. This can include not understanding the implications of producing and consuming a good. There is still missing or incomplete information surrounding the environment even in data rich countries such as Australia, and sometimes even when information is available, it is not easily accessible to policy makers, producers or consumers, or is not in a form which can be used. Responses to market failureSometimes market failure is dealt with through private solutions. For example, there are many documented cases of common property that are well managed by their communities via mechanisms such as social rules[7]. Other times, groups of individuals may work together to provide a public good – such as when individuals form a non-government organisation that manages a conservation area. In other cases, the existence of market failure causes significant enough problems to justify government intervention. Government responses to market failure include the options below – the categories are presented separately, but there is overlap between most of them.

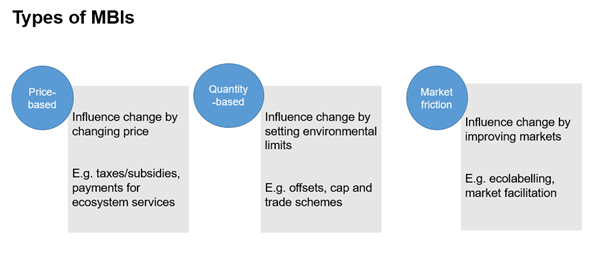

The benefits of market-based instruments are that they can help achieve environmental outcomes at a lower overall cost to society than other options such as direct provision or regulation. This is because individuals and businesses possess the information they need to make the decisions about the right level of production and consumption when externalities are factored into prices. Many market-based instruments can also help encourage ongoing innovation and creativity. When individuals or businesses facing higher prices for an action or are given the opportunity to make money by selling credits, they are incentivised to find new ways to make or save money, and these methods might include new approaches and technologies. Regulation is often required to establish new markets. For example, regulating a cap on pollution or the amount of carbon that can be emitted per company, and then allowing trading, is the basis for a compliance market such as the EU Emissions Trading Scheme. These regulated markets are often the largest[9]. Governance around transparency and verification is key to successful and sustainable environmental markets[10]. Careful monitoring is also important. Effectiveness has not been measured for many payment-for-ecosystem market and offset schemes, which means it is difficult to determine if they have achieved their environmental objectives[3][4]. Despite the potential benefits of market-based instruments, they do not provide the right solution for every problem. They may even be harmful. One international report estimated subsidies harmful to biodiversity – for example, those that encouraged activities that exacerbate biodiversity loss through land and ocean degradation, unsustainable use of resources or overuse of inputs - were worth approximately US$542 billion in 2019 (not including fossil fuel subsidies)[1]. Understanding the costs and benefits involved with various responses to market failure can help inform decisions on interventions. Paying attention to whether an action generates private costs or benefits is important to help pick the appropriate response[8]. For instance, if an activity generates private benefits but it is not being adopted, then information provision via activities such as extension might be appropriate. Short term incentives might also be useful to initiate adoption. However, if there are no private benefits to an action, but there are private costs, information provision is unlikely to be effective for much of the population. In this instance, providing long term subsidies or payments, for instance, via a stewardship scheme, may be required. References

Last updated: 11 June 2024 This page should be cited as: Department of Environment, Science and Innovation, Queensland (2024) Role of markets in the environment, WetlandInfo website, accessed 8 May 2025. Available at: https://wetlandinfo.des.qld.gov.au/wetlands/management/wetland-values/economic-valuation/market-limitations/ |

— Department of the Environment, Tourism, Science and Innovation

— Department of the Environment, Tourism, Science and Innovation